|

||||||||

| November 29, 2017 | ||||||||

| More knowledge, better results |  |

|||||||

|

· Subscribe to Ahead of the Curve · Newsletters · Ahead of the Curve archived issues · Contact the Editor

|

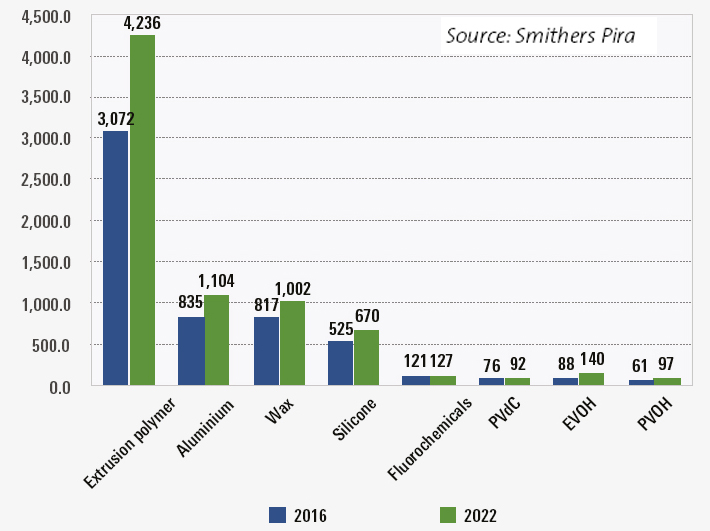

Market and technology developments for paper and board coatings Functional and barrier (F&B) coatings are an exciting area of development for the paper and board markets—offering enhanced functions, performance, and driving growth in particular end use markets. In its latest report on the subject, The Future of Functional and Barrier Coatings for Paper and Board to 2022, Smithers Pira looks at the state of the marketplace globally, and some of the key technology developments underway that will impact the future of the market through to 2022. Market forecasts The Asia-Pacific market sector will represent over half of worldwide functional and barrier coatings use by 2022, up from 46 percent in 2012, with Japan the only major economy in the region expected to have a reduced demand. China leads the way with over a third of world demand.

The Western, more developed, markets will show more modest growth in demand. Flat demand will continue in the Europe Middle East Africa (EMEA) markets, bolstered slightly by markets in Eastern Europe and the Middle East countries, which will continue to show consumption growth. Europe is projected to be the next largest consuming market after Asia; followed closely by North America at 16.1 percent; South and Central America at 5.0 percent; and minor shares for the Middle East, and for Africa. Technology changes The largest volume trend in technology is the rapid growth of bio-based polymer alternatives like polylactic acid (PLA), polyhydroxyalkanoates (PHA) and polyhydroxybutyrate (PHB) to replace petroleum-based plastics like polyethylene in extrusion applications. Nanopolymers and formulated water-based polymers using a variety of structured pigments are also being used more. Water-based systems using advanced emulsion polymers are showing growth rates exceeding 14 percent in some markets, such as North America. Hydrogenated tallow di-glycerides have also shown strong growth in recent years, replacing petroleum-based wax, particularly in the North American containerboard market. Waterborne polyethylene terephthalate (PET) technologies from AkzoNobel are also becoming of more interest as a sustainable alternative to polyethylene laminates and wax in many market applications. Growing demand for responsive and active packaging are finding more markets for antimicrobial products and environmentally sensitive functional coatings. Cost will continue to drive the market to search for innovative approaches to replace fibre content. The use of micro-fibrillated cellulose and functional coatings will reduce the amount of fibre needed, while maintaining package strength and integrity. Paper and paperboard laminations will be looked at harder for these types of applications. The marketplace continues to demand functional and barrier coatings for paper and paperboard that will provide added benefits to the product, retailer, and consumer. Responsive packaging systems designed to react to stimuli in the food or the environment, to enable real-time food quality and food safety monitoring or remediation, is a growing field of use. These coatings are capable of exhibiting changes in physical or chemical properties in response to external stimuli – including pH, temperature, light and biological activity among others—thereby eliminating waste.

Antimicrobial packaging is another area of emerging “intelligent” coating technology interest, and it is rapidly advancing with the application of nanotechnology and natural antimicrobials. These and other trends are discussed in the Smithers Pira report The Future of Functional and Barrier Coatings for Paper and Board to 2022. For a modest investment of $174, receive more than US$ 1000 in benefits in return. |

|||||||

|

||||||||