|

||||||||

| December 3, 2014 | ||||||||

| Valmet's new LignoBoost technology gaining foothold |  |

|||||||

|

· Subscribe to Ahead of the Curve · Newsletters · Ahead of the Curve archived issues · Contact the Editor

|

UPM Demonstrates Leadership in the European Publication Market

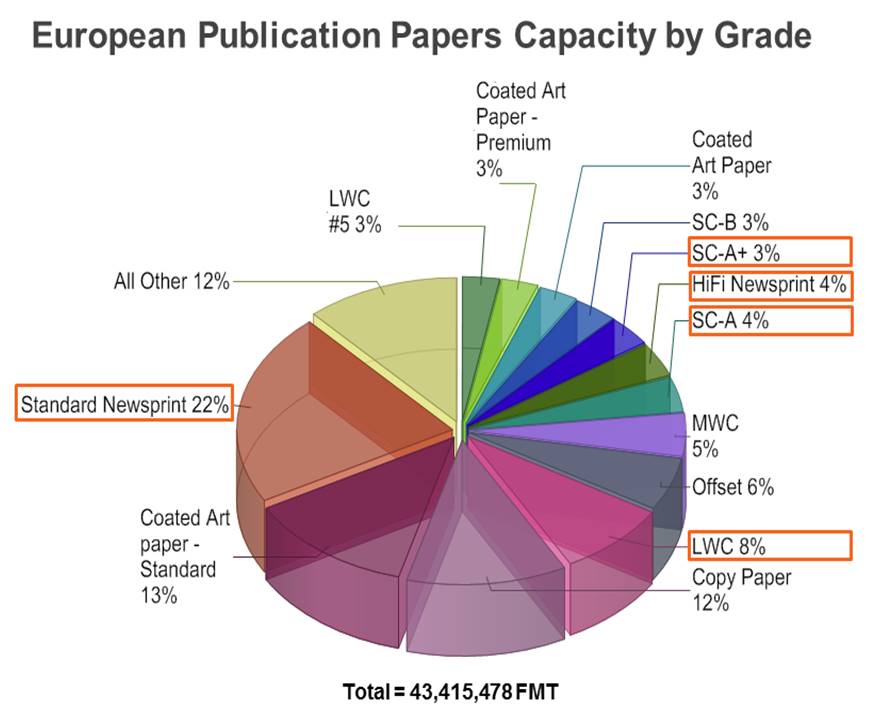

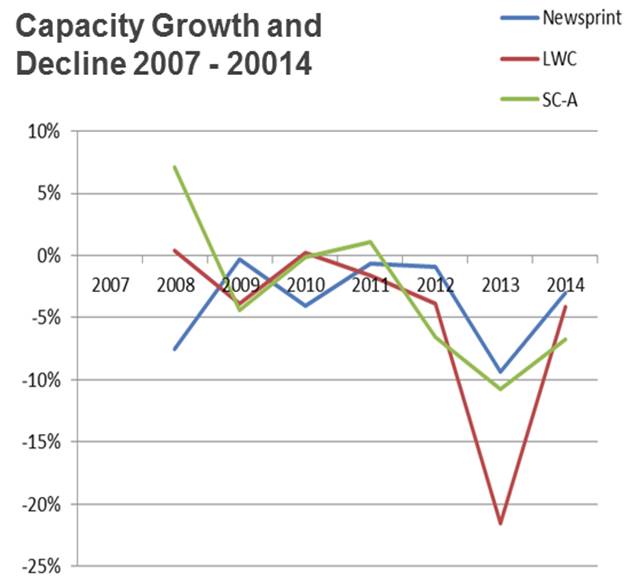

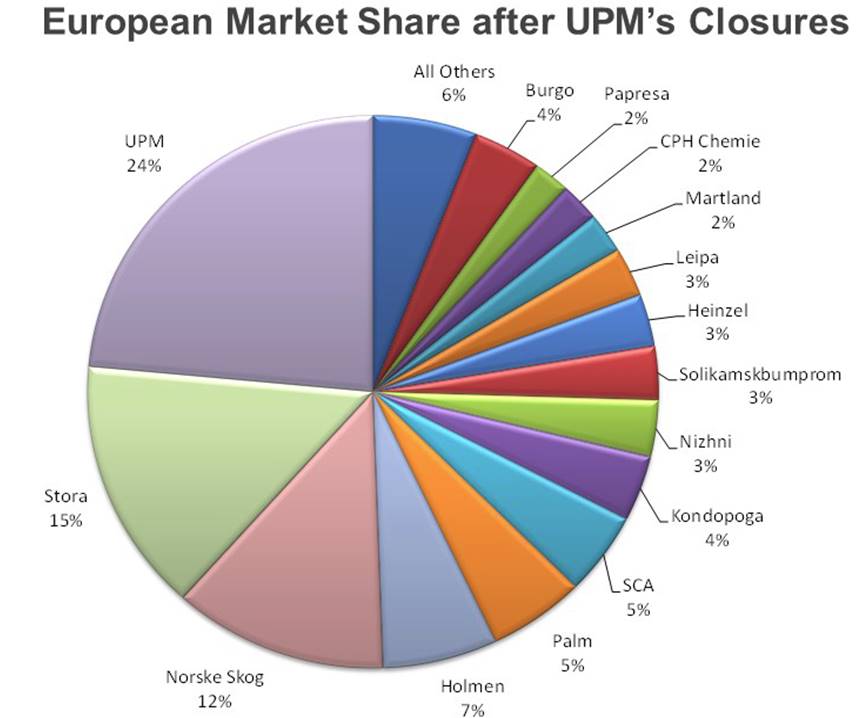

(Editor's Note: This article is courtesy of Fisher International) By Urban Lundberg On November 13, 2014, UPM announced that they, as part of a major profit improvement initiative, will remove over 800,000 MT per year from the European publication paper market by permanently shutting down four paper machines in 2015. The machines affected are the newsprint machines PM 3 in Chapelle, France, and PM 1 at Shotton, UK. In addition, the SC producing PM 5 in Jämsänkoski, and the Coated Mechanical PM 2 in Kaukas, both in Finland, are to be shut down. The closures represent over 14 percent of UPM’s capacity in newsprint and SC-A grades, and 10 percent in LWC. The European publication paper market, consisting of newsprint and printing and writing grades, has a current capacity of about 43.4 million MT (Figure 1), and has been suffering from declining market demand and low operating rates. Once the UPM closures take effect, the specifically affected grades (newsprint, LWC, and SC-A grades) will have experienced a collective decline in European capacity of 17 percent in the three years 2012 to 2014. Newsprint capacity will have declined 12 percent, LWC an astonishing 25 percent, and SC-A grades 17 percent. Together, the affected grades represent 43 percent of the total European capacity for printing and writing and newsprint. One in every six tons of affected European capacity has been shuttered in just three years. This dramatic decline helps to bring supply and demand closer into balance since demand declines out-paced supply closures for several years before 2012. But are the closures enough? Seventeen percent in three years sounds like a lot. However, in markets where demand could be declining at about that rate, the last three years of closures may actually just keep pace. Moreover, since there already was significant overcapacity in 2012, and since markets continue to decline, still more will be needed. Figure 2 shows why: the pace of closures was much slower than demand declines until 2013.  There has been a continuous capacity decline since 2007. Source: FisherSolveTM © 2014 Fisher International, Inc. UPM’s overall market share for the affected grades will, after the closures, be 24 percent and their clear number one position will remain unchanged (Figure 3). Notice how many players hold small market shares and how few (UPM, Stora Enso, and Norske Skog) hold shares greater than 10 percent, indicating a still fragmented market.

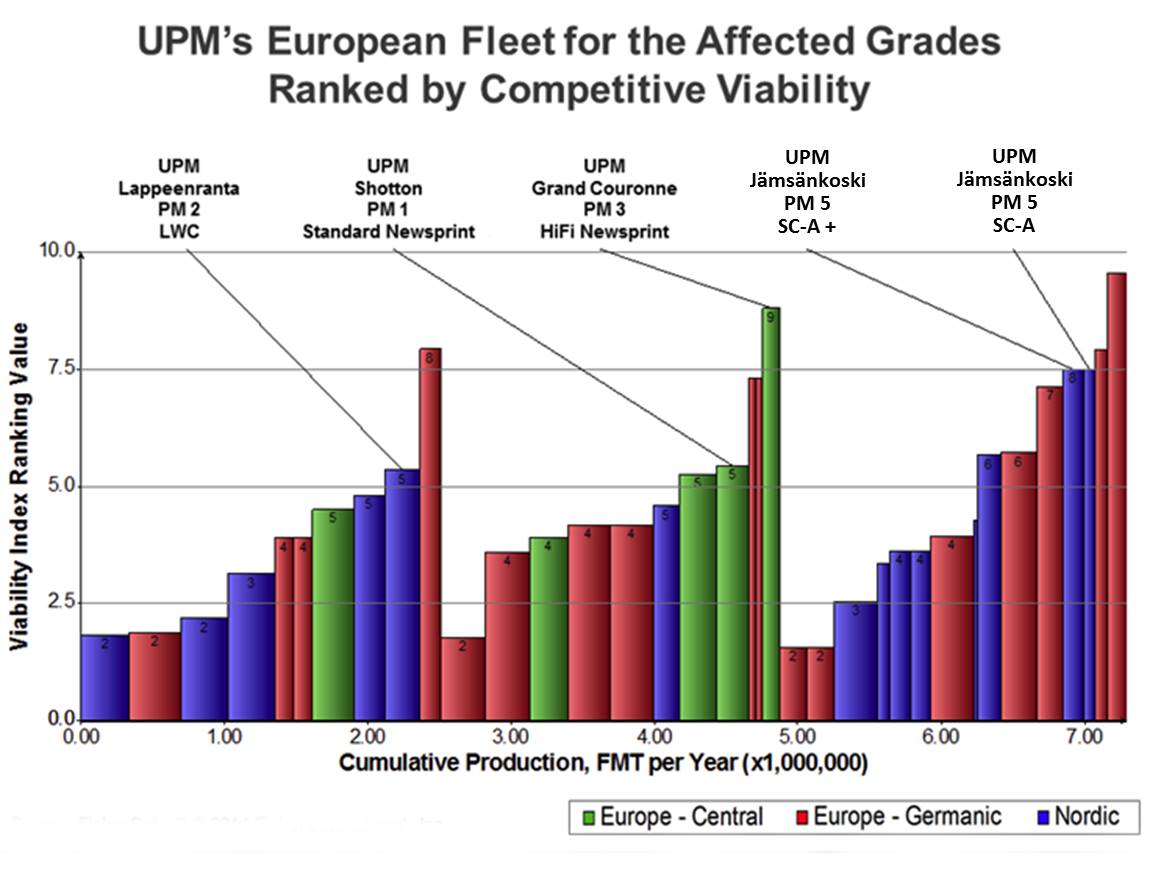

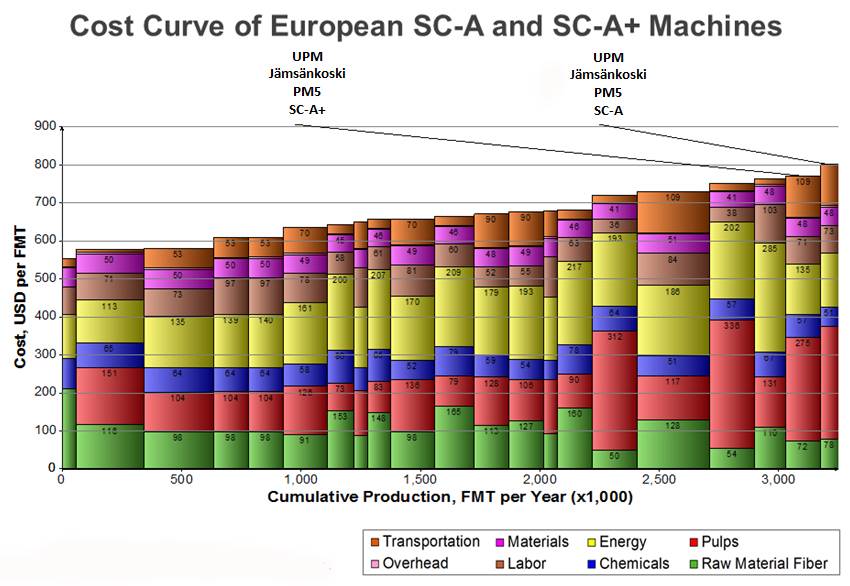

Figure 3. Market shares in the affected publishing paper market segments after completion of the UPM reductions. Source: FisherSolveTM © 2014 Fisher International, Inc. CLOSURE DECISIONS DRIVEN BY COST AND LONG-TERM VIABILITY CONSIDERATIONS The machines that will close are, in some cases, large, relatively competitive assets within Europe. So, why did UPM select them for closure? The FisherSolve Benchmark Viability tool provides insights using factors such as asset quality, scale, capital requirements, and others as well as costs. While there are certainly other less competitive machines in Europe, the machines earmarked for closure were the logical choices for UPM. In Benchmark Viability terms, they were mainly UPMs least competitive machines. As you can see in Figure 4, they have the highest risk scores within UPMs fleet with a couple of exceptions: UPM will continue to operate machines located in Germany where demand is strongest and logistics costs to serve the area are lowest. Using SC-A grades to illustrate (Figure 5), the shuttered machines are the highest-cost machines delivered to Frankfurt in all of Europe and logistics costs are the problem.

FisherSolve™ Benchmark Viability shows that UPM closed its weakest performers, sparing only a couple of weak assets located in Germany (red bars), most likely because their location provides better logistics advantages than the Finnish assets that will close. Source: FisherSolveTM © 2014 Fisher International, Inc.

Logistics cost is one of the main problems for PM 5 in Jämsänkoski, slated to be shuttered. Source: FisherSolveTM © 2014 Fisher International, Inc.

Logistics cost is one of the main problems for PM 5 in Jämsänkoski, slated to be shuttered. Source: FisherSolveTM © 2014 Fisher International, Inc.

WHAT WILL HAPPEN NEXT? The planned reductions from UPM can be seen as one step in the company’s ongoing long-term transition to a fiber and biomass company, less dependent on paper. The capacity reductions, although considerable for the overall European publication market, will not fully address the problem. The overall rate of closure in all printing and writing and newsprint grades has yet to match the rate of demand decline. The market’s fragmentation suggests that producers may consolidate. Where will more closures come from? Clearly market leaders can keep their leadership positions only if they don’t close too much capacity. UPM cannot be the only one to shutter assets and remain a large player. However, smaller players can hardly be expected to sacrifice large parts or all of their productive capacity voluntarily. We continue to believe that market balance will also have to come the hard way, through bankruptcies. Urban Lundberg is a Senior Consultant at Fisher International. For more information about how the European industry is likely to evolve, please contact Fisher International at: www.fisheri.com. Now that you

are Ahead of the Curve, stay there by joining TAPPI. |

|||||||

|

||||||||