|

||||||||

| December 10, 2014 | ||||||||

| Tissue success - a matter of mutual trust |  |

|||||||

|

· Subscribe to Ahead of the Curve · Newsletters · Ahead of the Curve archived issues · Contact the Editor

|

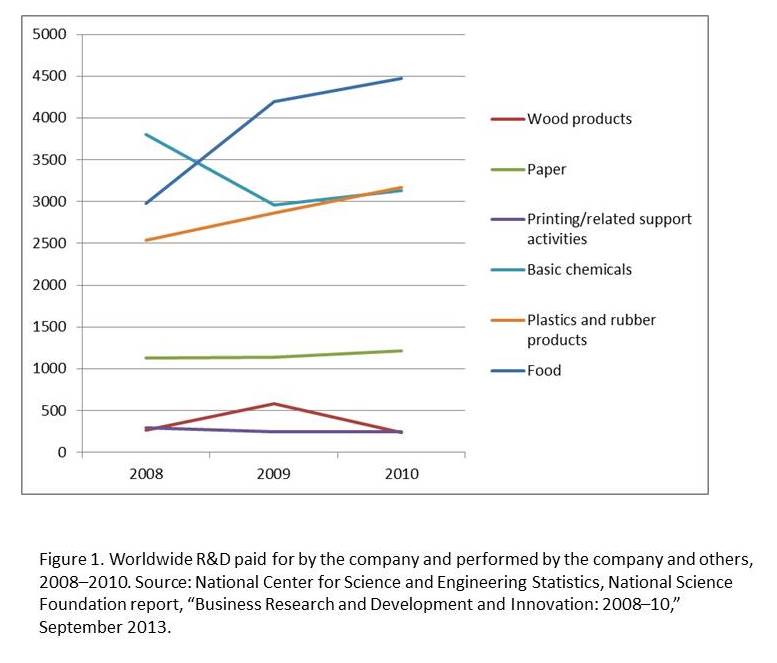

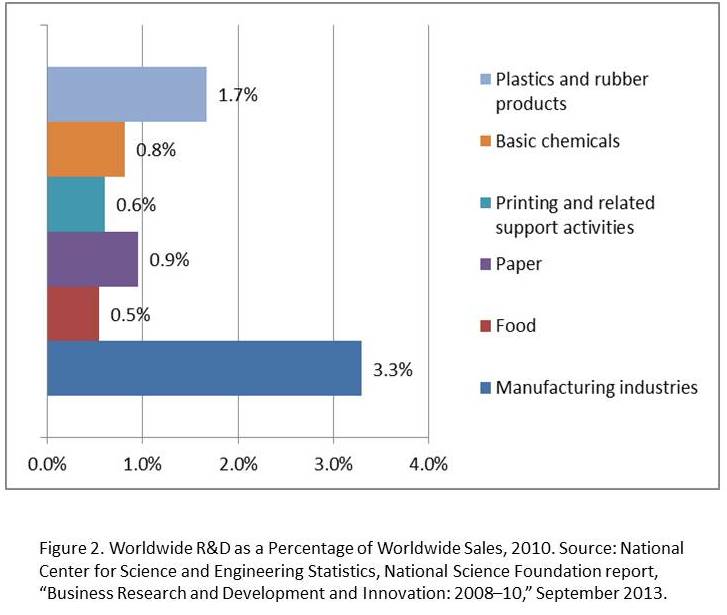

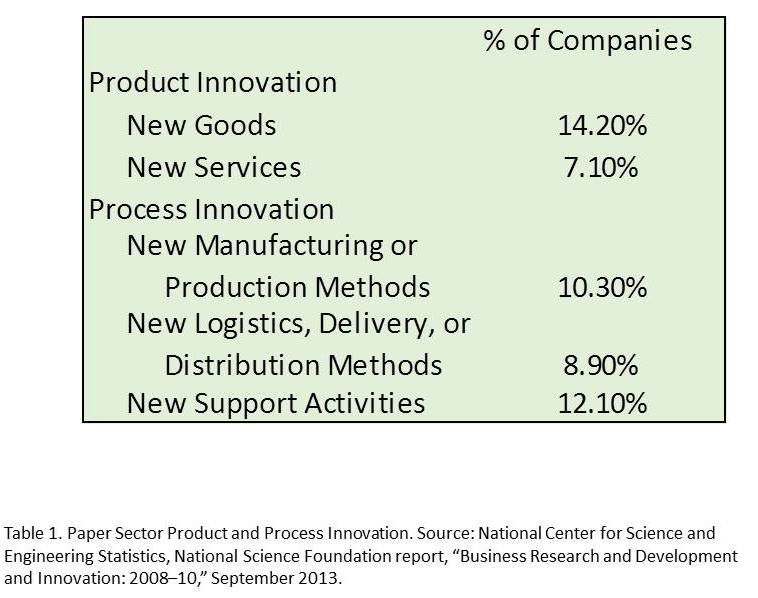

Research & Development in the Pulp and Paper Industry (Editor’s Note: This article first appeared in the October 23, 2014 issue of the CPBIS newsletter) By Patrick McCarthy A recent Paper 360° article (“Pulp and Paper Innovations,” July/August 2014), highlighted eight significant innovations: aseptic packaging, chlorine-free bleaching, high filler content paper, twin wire forming retrofits, extended nip presses, highly energy efficient chemical recovery boilers, millwide control systems, and biochemical production. As noted in the article, the industry’s record of innovation has helped the industry meet increasing competitive, environmental, and energy challenges. This article takes a more recent and broader look at the industry’s research and development activities and how these compare to other manufacturing sectors. The National Center for Science and Engineering Statistics, National Science Foundation, published a lengthy report in September 2013 (“Business Research and Development and Innovation: 2008–10”), that provides detailed information on the domestic and international research and innovation activities of industrials sectors. Research and Development Figure 1 reports the worldwide amount of R&D that the pulp and paper sector and benchmark sectors performed in 2008 through 2010. In 2008, the largest R&D expenditures were in basic chemicals ($3.8 billion), food ($2.9 billion), and plastics and rubber products ($2.5 billion) sectors. The paper manufacturing sector was significantly below this at $1.1 billion in 2008. In 2010, basic chemicals, food, and plastics and rubber product sectors remain high but the graph reveals some dramatic shifts during the 3-year period. Worldwide R&D in the food industry increased 50% but decreased 18% in basic chemicals. The plastics and rubber sector, a competitive sector for pulp and paper, increased 25% compared to a 7% increase in the paper sector. During this 3-year period, worldwide R&D for the paper sector remained relatively low and flat. For the paper industry, 72% of the sector’s R&D occurs domestically. This is down from 79% in 2008 but generally similar to the food (79%), textile (76%), basic chemicals (72%), and plastics (76%) sectors, while 92% and 82% of the printing and wood products sectors’ R&D occurred domestically in 2010. Figure 2 reports worldwide R&D conducted in 2010 as a percentage of the sector’s worldwide sales. For the manufacturing sector, R&D accounted for 3.3% of worldwide sales, considerably greater than the paper sector and its benchmark industries. R&D in the paper manufacturing sector was 0.9% of sales (the average for the reported benchmark sector). Although less than the manufacturing sector, as a percent of worldwide sales, R&D expenditures in the plastics and rubber products sector (1.7%) was nearly twice that in the paper sector. Product and Process Innovation Another indicator of innovative activities is the introduction of new products and new manufacturing processes. For the paper sector, Table 1 provides information on the proportion of surveyed companies that engaged in product or process innovation and the type of innovation. Overall, 19.8% of companies in the paper manufacturing sector identified new or significantly improved product or process. From Table 1, 14.2% of pulp and paper companies introduced new goods compared with 7.1% of the companies that introduced new services. A similar proportion (8% - 12%) of companies engaged in various types of process innovation where the focus was more on logistics and support than on new production methods. How does this compare with pulp and paper’s benchmark sectors including: food, textiles, apparel and leather products, wood products, printing and related support activities, chemicals, and plastics and rubber products? On average, 27.7% of these companies introduced new products or significantly improved products or processes?a larger proportion than for the paper sector. The top performing sectors in these margins were the chemical (46.1%) and plastics and rubber products companies (34%).

In sum, the NSF Report offers an excellent overview of recent business research, patenting, and innovative activities and, as suggested here, provides a general basis for determining whether the pulp and paper industry is “research competitive” with other sectors, particularly those whose products are part of the paper industry’s supply chain (e.g. wood products, chemicals), or whose products are direct competitors in the marketplace (e.g. plastics).

Pat McCarthy is Professor of Economics, and Director, Center for Paper Business and Industry Studies, Georgia Institute of Technology. He can be reached at: mccarthy@gatech.edu. This article first appeared in the October 23, 2014 issue of the CPBIS newsletter. Now that you

are Ahead of the Curve, stay there by joining TAPPI. |

|||||||

|

||||||||