|

||||||||

| February 18, 2015 | ||||||||

| Rick's Tips - Reel Primary Arm Maintenance |  |

|||||||

|

· Subscribe to Ahead of the Curve · Newsletters · Ahead of the Curve archived issues · Contact the Editor

|

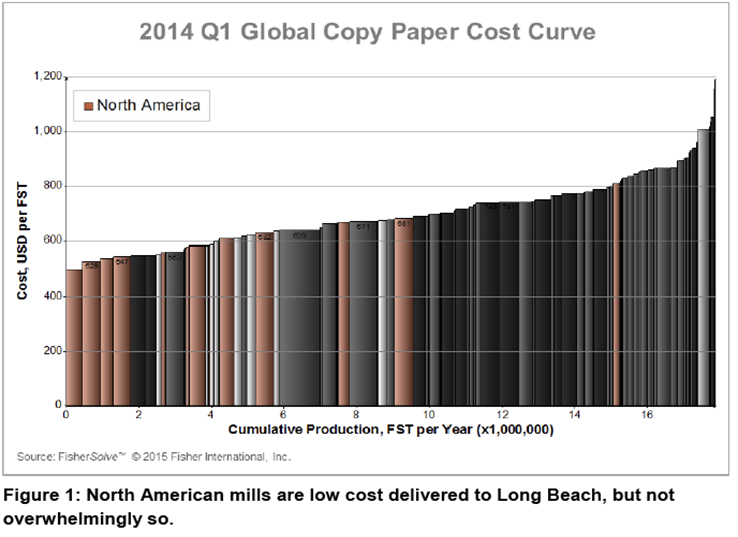

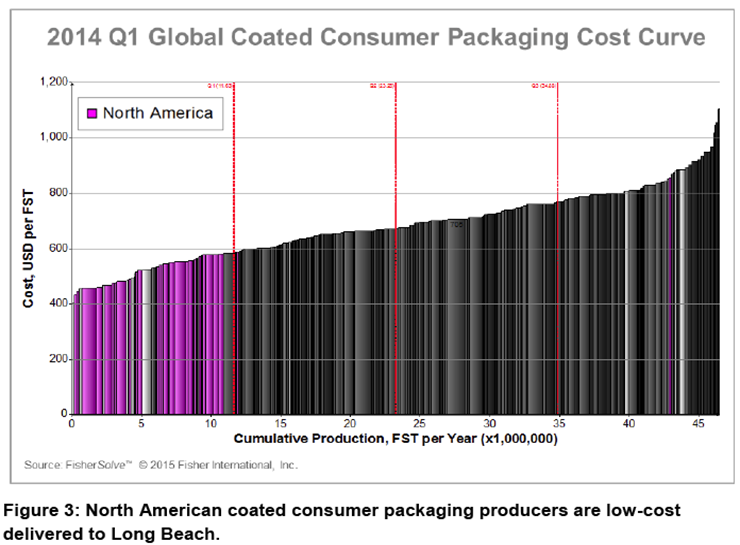

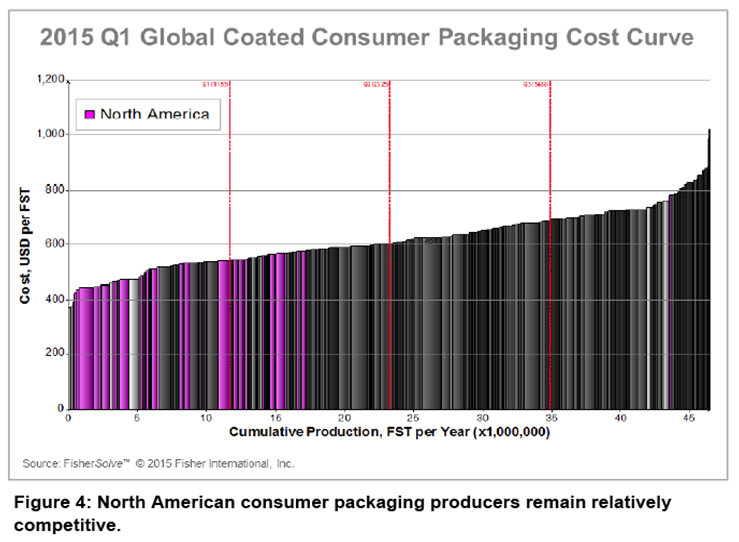

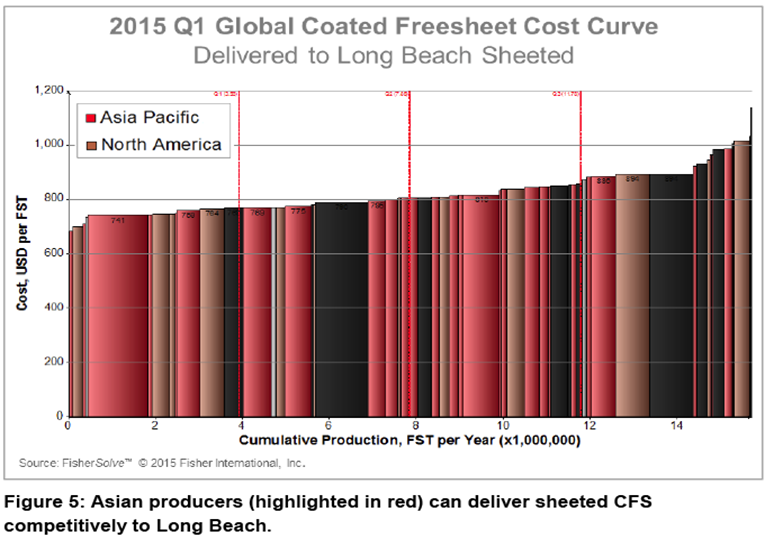

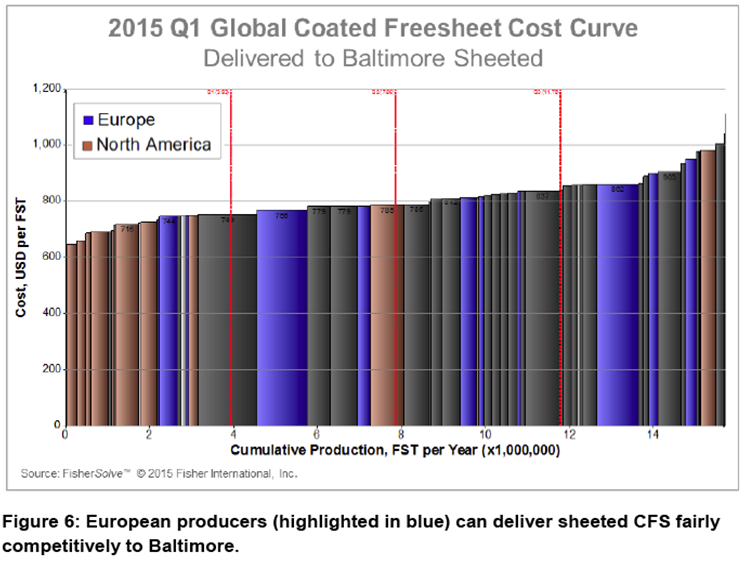

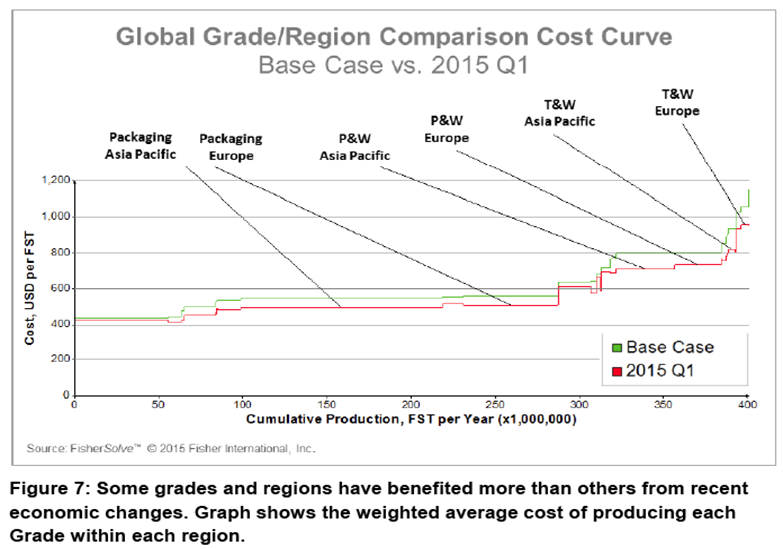

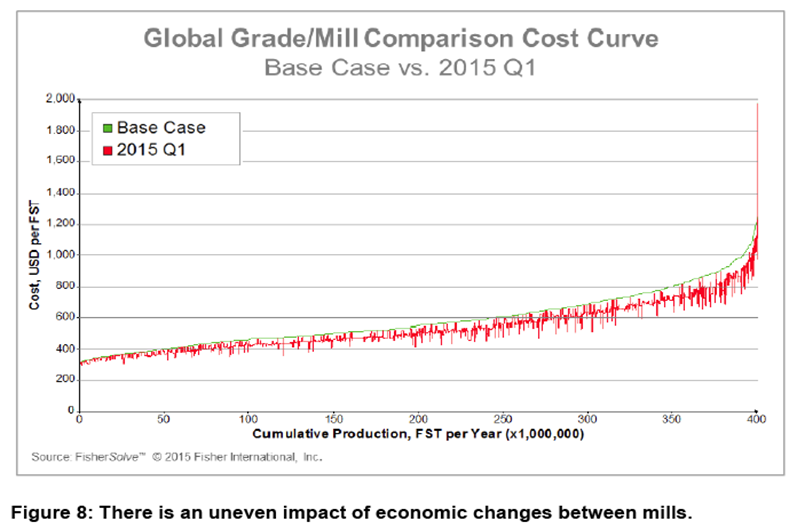

2015 Begins with a Rollercoaster Ride By Rod Fisher The world economy sometimes feels like a rollercoaster and the beginning of 2015 is one of those times. The U.S. dollar has moved sharply up, oil prices have fallen by half, hardwood pulp prices are down and the gap with softwood is increasing. Lower oil prices make transportation—an important paper industry cost—less significant as a portion of total cost and make the prices of many chemicals lower, too. As the prices of key inputs gyrate, most mills experience a combination of wins and losses. Since competitiveness is measured relative to peers, even if a mill’s costs go down, it’s still possible for economic changes to be bad news. While none of these changes are in anyone’s control, it’s important to understand what’s happening: competitive positions determine where investment goes and, in extreme cases, which assets get shut down. So, who is winning and who is losing now? The costs and benefits of these changes are unevenly spread: mills burning fuel other than oil, rely on softwood or make their own hardwood pulp, have USD costs, and ship shorter distances lose the most ground relative to their peers. Energy independent mills and mills that burn oil, buying hardwood pulp, using less softwood, shipping longer distances, and buying in currencies not pegged to the USD have gained ground. Let’s look back just twelve months to the first quarter of 2014 and see how much competitive positions have changed and what their impact might be. Figure 1 shows a global Copy Paper cost curve from the beginning of 2014, delivered to Long Beach, California. North American mills are highlighted showing that although they occupy the lower half of the cost curve, there are other (non-North American) mills well able to compete in North America. Since Copy Paper is oversupplied in both Asia and Europe, it is not surprising to see a significant and growing part of the North American market already suffering from imports. Figure 2 shows the damage that recent economic changes have wrought on North American competitiveness. Exchange rates obviously favor foreign producers. Most other major economic changes also do: North American producers, on the whole, do not use oil and do not buy hardwood pulp. What’s more, lower oil prices favor the logistics costs of exporters to North America more than those of domestic producers shipping within the continent. Many foreign producers are able to compete when price includes transportation costs to North America’s west coast. This explains some of the recent growth in uncoated freesheet imports and suggests that the trend may increase. Consumer packaging is another grade where one might expect a market response similar to Copy Paper. Figure 3 shows North American mills’ competitiveness a year ago making Solid Bleached Sulfate (“SBS”), Solid Unbleached Sulfate (“SUK”), Folding Boxboard (“FBB”), and Coated Recycled Board (“CRB”). At that time, North American producers occupied the first quartile delivered to Long Beach. The change over the last year in consumer packaging, however, is not as dramatic as in Copy Paper. Figure 4 shows that North American producer costs are still significantly better than most foreign competitors, although there clearly are some with the ability to ship at competitive prices to Long Beach. Having said this, North American producers have the additional advantage of making kraft-based consumer packaging grades (SBS and SUK) whereas foreign products contain more mechanical and recycled furnishes, making them less attractive to North American consumers. For both these reasons, imports of consumer packaging have made less headway in North America. A third and last example is coated freesheet (“CFS”), a segment that is oversupplied nearly everywhere in the world. CFS also has two basic forms, rolls and sheets. Sheeted products have a higher labor content than rolls which favors producers in regions with low labor rates such as Asia. North America has imported significant amounts of CFS for many years now and the likelihood is that imports will grow further. Figure 5 shows why. For converted coated freesheet products, foreign players are just as competitive delivered to Long Beach as North American producers. Figure 6 shows converted CFS costs delivered to Baltimore where the situation is only slightly less dramatic. I focused on North American competitiveness in this article because the strengthening U.S. dollar affects that region in particular. However, other factors—oil and hardwood prices, for example—are having uneven effects on grades and regions across the world. Figure 7 shows the larger gaps between the average costs of a year ago and today in some grades/regions. The difference is even more dramatic at the mill level. For mills still burning oil, the total cost improvement from all factors between a year ago and today is as much as $250 per ton. Those mills, particularly if they export to North America, should be especially advantaged under today’s conditions. Figure 8 shows how much. Most mills in the world have experienced reduced costs to some degree, resulting in billions of dollars of lower costs for the industry as a whole. For those that export to the U.S, there have been additional gains in exporters’ competitiveness vis-à-vis domestic producers. Whether these cost improvements result in greater profitability for paper producers depends on how much of the newly-created savings is passed on to customers. Given the unevenness of the impact of economic changes between mills, some savings will accrue to selected mills but not to their direct competitors. Since price levels in those situations are less likely to change, some of the industry’s savings will at least stay with the mill owners and overall industry profitability in many areas is likely to look better. Rod Fisher is president of Fisher International and can be contacted at: rfisher@fisheri.com. Now that you are Ahead of the Curve, stay there by joining TAPPI. |

|||||||

|

||||||||