|

||||||||

| November 30, 2016 | ||||||||

| Rick's Tips - Winding Principles, part 1 |  |

|||||||

|

· Subscribe to Ahead of the Curve · Newsletters · Ahead of the Curve archived issues · Contact the Editor

|

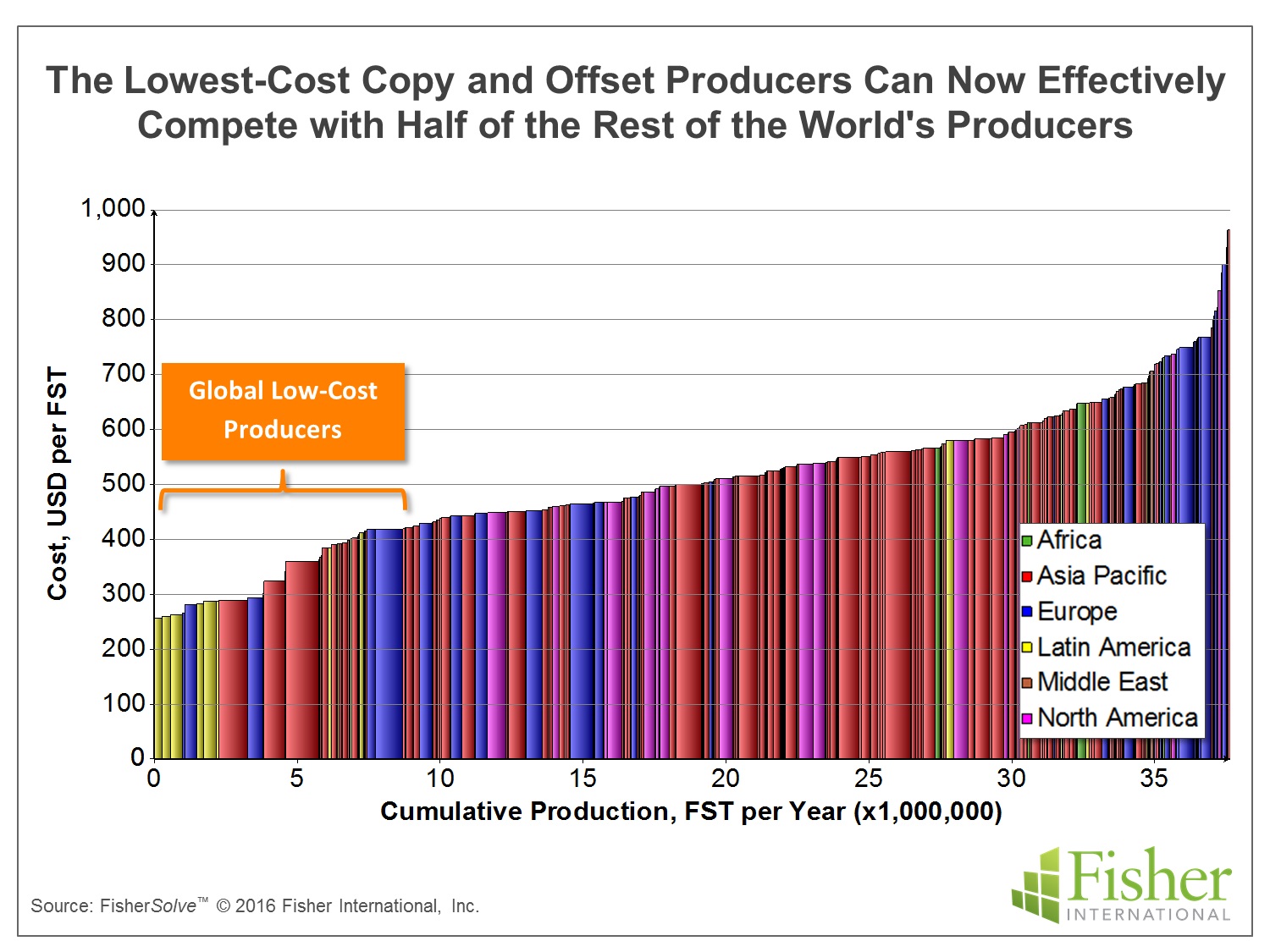

The Perfect Storm: Foreign Exchange, Shipping Rates, Oil Prices, and the Pulp and Paper Industry By Ming Tan, Analyst and Product Manager, Fisher International There is a storm gathering on the horizon and it has the potential to hit US shores with disruptive effect. The storm’s winds are caused by the dramatic change in the cost of trade that has occurred in the last fifteen months. It is, in fact, a “perfect storm” in its potential effect on US paper manufacturers.

A perfect storm requires three coinciding forces that reinforce each other. In this case, they are a glut of ships, low energy costs, and a strong US dollar. Too many ships have forced down the price of chartering a ship. Low energy prices have forced down the cost of operating a ship. And a strong US dollar has forced down the cost of goods exported to the US. Taken together, non-US suppliers face an unprecedented opportunity to increase their exports to the US. Shipping Glut Shipping companies just finished building large amounts of capacity in massively big ships. A few years ago, the demand for Chinese goods was still high and apparently growing without limit. Shipping was tight so the shipbuilding began. As is the case for paper machines, in the world of ocean shipping, bigger is always better. Moreover, the newly-widened Panama Canal expansion, set to open in mid-2016, allows much larger ships to navigate through. So, shipping companies built mega ships—some even longer than the Eiffel Tower. More ships times bigger ships yielded much more capacity than the world needed. Then, over the past two years, global growth in demand for exports from China declined. Demand for shipping weakened just as capacity increased. As a result, container ships are available at phenomenally low shipping rates. Energy Prices and Currency Most people don’t need to be told that the US dollar is strong today. The consequence of currency relationships is that a paper company in the Eurozone exporting to the US has seen the cost of its products drop in the last five years. Any paper manufacturer that was offered a project to lower its manufacturing costs a corresponding amount would hardly believe it possible—but currency fluctuation has made it so. The Impact Australia is the second largest exporter of containerboard to the US. From 2013 to 2014, their exports grew by more than 200%, coincident with the strengthening of the US dollar against the Australian dollar and the fall in shipping costs. While US printing and writing paper imports have been declining for some time, their share of the US market has been increasing, indicating that these imports have become more competitive. As US demand fell, domestic capacity closed even faster and imports took up some of the slack, causing imports’ share to soar.

The increase in the competitiveness of imports is correlated with the fall in shipping costs and changes in foreign exchange rates. The trade case won by uncoated freesheet producers may protect further erosion, but it has to overcome the logistics and currency forces arrayed against it. Outside the US, currency rates and shipping costs affect the trading of pulp and paper products. China imports a considerable quantity of Northern Bleached Softwood Kraft (NBSK) pulp. Between 2012 and 2014, while the exchange rate between the Canadian dollar and Chinese Yuan was flat, the NBSK imported from Canada to China was also relatively flat. However, starting in 2014, the Chinese Yuan became stronger against the Canadian dollar and that triggered Canadian imports to grow in China. It’s noteworthy that the NBSK export peak in 2015 correlates with the rock bottom shipping rates. Conclusion

Look at a cost curve for any paper product and make it global. See if there’s a US$200 or greater difference between a major low-cost producer with plenty of capacity and the top half of the cost curve and you will find a papermaker who is positioned to capitalize on the recent globalization of the paper industry.

For a modest investment of $174, receive more than US$ 1000 in benefits in return. |

|||||||

|

||||||||