| |

· www.tappi.org

· www.tappi.org

· Subscribe

to Ahead of the Curve

· Newsletters

· Ahead

of the Curve archived issues

· Contact

the Editor

|

|

|

|

Outlook 2019: The Trade War Threat Looms

BY GRAEME RODDEN

Editor's note: This article is an excerpt of a feature in the upcoming issue of Paper360°, which will be available later this month. It is offered here as a special "sneak peek" for Ahead of the Curve readers. For the complete article and more, visit paper360.tappi.org.

Trade issues and pulp dominated discussions during the final two days of RISI's annual North American forest products outlook conference, held in San Francisco, CA, in October. After opening with a look at the future of the wood products market, day two's theme was: Cost and Supply Chain Challenges for Pulp, Paper, and Beyond.

Lasse Sinikallas, RISI's director of macroeconomics, noted that the global economy is still growing, but moderately, and faces heightened risks. All economies (developed and emerging) have done well in the past few years and this should continue. However, inflation has gone up recently mostly due to higher oil prices, which are at their highest in four years.

Politics is an increasing concern. Economic policy uncertainty is elevated globally, Sinikallas said. The US economy has grown, he added, but faces continued uncertainty with President's Trump's policies, which pose a "serious concern." He also noted that US labor productivity is low. With very low unemployment levels, he fears a tightened labor supply could promote inflation.

In China, the transition continues. There is concern about the level of debt and the fear of an all-out trade war with the US adds an additional risk. The industrial side of China's economy is settling and there is not likely to be significant growth. Sinikallas expects China's economy will decelerate slowly and he does not expect a "crash landing". But, he warned, there is always a level of doubt in the truthfulness of any statistics released by the government.

In Europe, geopolitical concerns (such as Brexit) may cause chaos. Inflation also poses a challenge. Is there a loss of momentum, e.g., falling retail sales?

Overall, Sinikallas said the world economy will look the same in 2018 and 2019. The US should perform well with some concerns. China is moving to consumer-led growth.

CHINA STILL THE STORY

RISI's Dave Fortin, vice president, fiber, gave the outlook for the global pulp market. Recent conditions have had a severely unsettling affect. Foremost among these are the "aggressive" import policies of China. This affects virgin pulp as well as recycled, Fortin said. It also affects trade flows. With the global economy improving, this means price hikes.

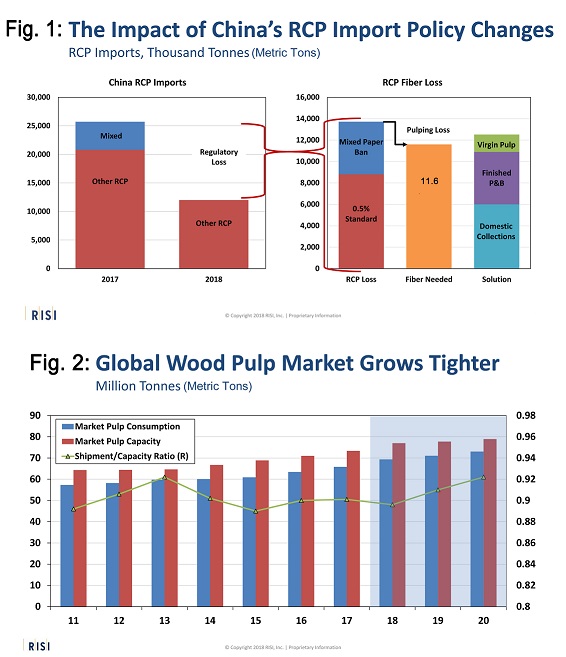

Fortin explained that China plans to ban all recovered paper (RCP) imports by 2020, although there is still some debate as to whether this will happen. Still, on March 1 of 2018, China imposed a maximum contamination level of 0.5 percent on all RCP imports. This compares to the traditional 1.5 percent level previously in effect. Since May, China has been inspecting all RCP containers coming from the US.

Another concern is the ongoing trade war between the two countries. This has global ramifications, Fortin stressed. He said that, given an estimated 85 percent yield from RCP, this mean 11.6 million metric tons of pulp will need to be replaced (Fig. 1). How? Virgin pulp is one solution. Others include increased imports to China of paper and board or increased domestic collection of secondary fiber. Its recovery rate is 64 percent now but quality is low and the supply chain is stretched.

The result has been an increase in RCP prices in China—but elsewhere in the world prices are low, so this RCP needs to find a new home. China has become a high-cost producer of recycled paper and board.

Elsewhere, in the virgin pulp sector, unexpected downtime (natural disasters, mill incidents, startup delays, etc.) has offset new capacity. RISI has started tracking this unexpected downtime. For example, through 3Q 2018, there has been 1.8 million metric tons of downtime among pulp producers.

Pulp inventories are low across the board, while paper and board markets are entering their traditionally strong season. Pulp prices are high, while paper and board prices are increasing. The price differential between dissolving pulp and bleached hardwood kraft remains narrow, bringing swing capacity back to paper grade.

In summing up, Fortin said that world production of paper and board is growing, albeit slowly. Most of this growth is in the packaging sector with a modest effect on pulp. The decline in graphic papers is slowing and tissue demand is growing, which has a positive effect on pulp.

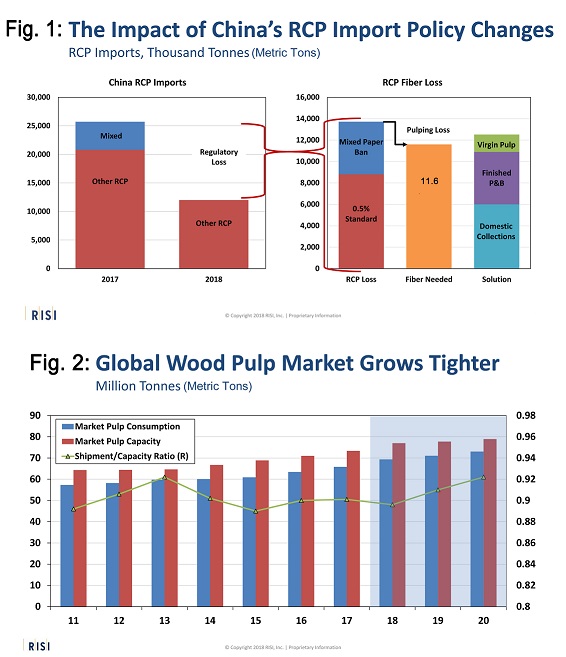

Even high-cost mills, hardwood or softwood, are now making money. The global supply of pulp is tightening as supply grows by 2 percent but demand climbs by 3 percent (Fig. 2). He sees markets conditions continuing to tighten in 2019. There are some major consolidations in the works, e.g., Suzano and Fibria, but even these won't offset pricing.

There were several panel discussions sprinkled through program. One looked at Trade Exposure and Trades Cases. Bonnie Myers, King & Spalding, was a featured panelist.

It was shown that there have been US$500 billion in tariffs imposed on Chinese goods as of 2019. This is for all sectors, not just forest products. This is equal to the total amount of goods imported.

Myers said the trade policies of the current US administration are confusing for many people, even "erratic and perhaps dangerous." She said that President Trump has made good on the promises he made in the 2016 campaign and added that he will be even "more aggressive" to gain concessions from trade partners.

What has led to this path? Myers pointed to four factors:

• The belief that trade deficits are a bad thing and need to be addressed. It does not matter if the trading partners are friends or foes.

• A preference to "buy American; hire American".

• Bad trade deals need to be re-negotiated or scrapped such as the trans-Pacific deal.

• Trade laws need to be strongly enforced.

Myers added that the president has signaled he intends to use "every trade remedy device in the toolbox". There is no doubt that President Trump has not been shy about taking on the traditional international trade order, i.e., the WTO. He believes the WTO dispute mechanism is broken.

Going forward, Myers advised, "Fasten your seatbelts; it's going to be a bumpy ride."

One delegate asked about the recent spate of Chinese purchases of North American pulp and paper assets. It relates back to China's need for fiber, which "trumps" tariffs and duties. But an all-out trade war brings recessionary factors into play, so demand could drop.

If a company gets involved in a trade case, what recourse does it have? Myers said it depends upon the importance of the trade to the company. It is worthwhile to defend yourself if the market is important. Get good counsel, she stressed.

About the author:

Graeme Rodden is senior editor, North and South America, for Paper360°. You can reach him at: grodden@tappi.org.

For a modest investment of $174, receive more than US$ 1000 in benefits in return.

Visit www.tappi.org/join for more details. |

|