| |

· www.tappi.org

· www.tappi.org

· Subscribe

to Ahead of the Curve

· Newsletters

· Ahead

of the Curve archived issues

· Contact

the Editor

|

|

|

|

Is Bath Tissue Really Wiping Out North American Forests?

BY JOANNA WILHELM, FISHER INTERNATIONAL

According to a recent Fisher International "Insight" article, a February 2019 report from the Natural Resources Defense Council (NRDC) resulted in several news articles and stories stating, "The Issue with Tissue." The NRDC report focused criticism on North American bath tissue producers for the amount of virgin fiber used in their products and the impact on the environment resulting from the cutting of boreal forests for the virgin fiber supply. It also reported that integrated virgin fiber mills use almost twice as much water and produce more air pollutants than recycled mills. The NRDC called on the tissue producers to shift to recycled content and sustainable alternative fibers, such as wheat straw and bamboo.

So, are commercial and consumer bath tissues the worst offenders when it comes to the quantity and percentages of virgin hardwood and virgin softwood fibers used? How do North American bath tissue producers stack up compared to the rest of the world in their use of recycled and other environmentally friendly fibers?

Furnish Sources

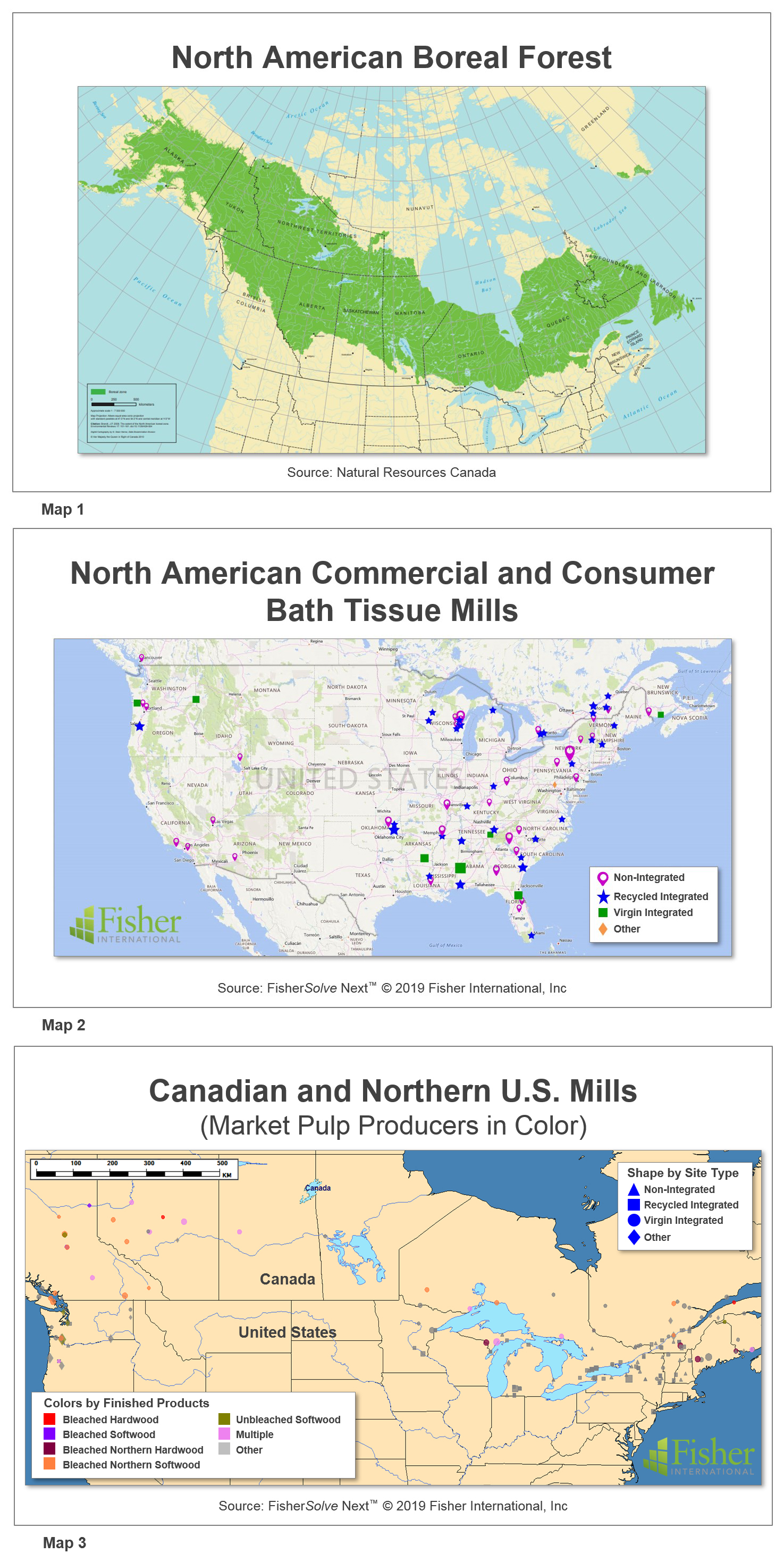

We hear the words "boreal forest" often when environmental issues around the paper industry are raised. What makes a forest a "boreal" forest? Primarily, it is the location, identified as a northern forest which will also influence the growing period and cycles, and the species (typically more softwood).

Boreal forests can be divided into northern and southern zones, including territory on the Canadian border and into the northern-most parts of Minnesota and Michigan. Southern boreal zone forests are productive enough to produce timber and fiber for paper pulp. Natural Resources Canada (NRCan) defines as boreal forest the covering shown on Map 1, which means that many Canadian market pulp and paper mills are going to have a tough time sourcing locally without getting into boreal growth.

There is some debate as to whether boreal forests can contain working forest, where seedlings are planted to reforest, or whether it is entirely unaided growth with no seedling plantings. Since the practice of planting in Canada and the northern US is very small, then for the purposes here, we will consider boreal forest to be regenerating naturally, without aid.

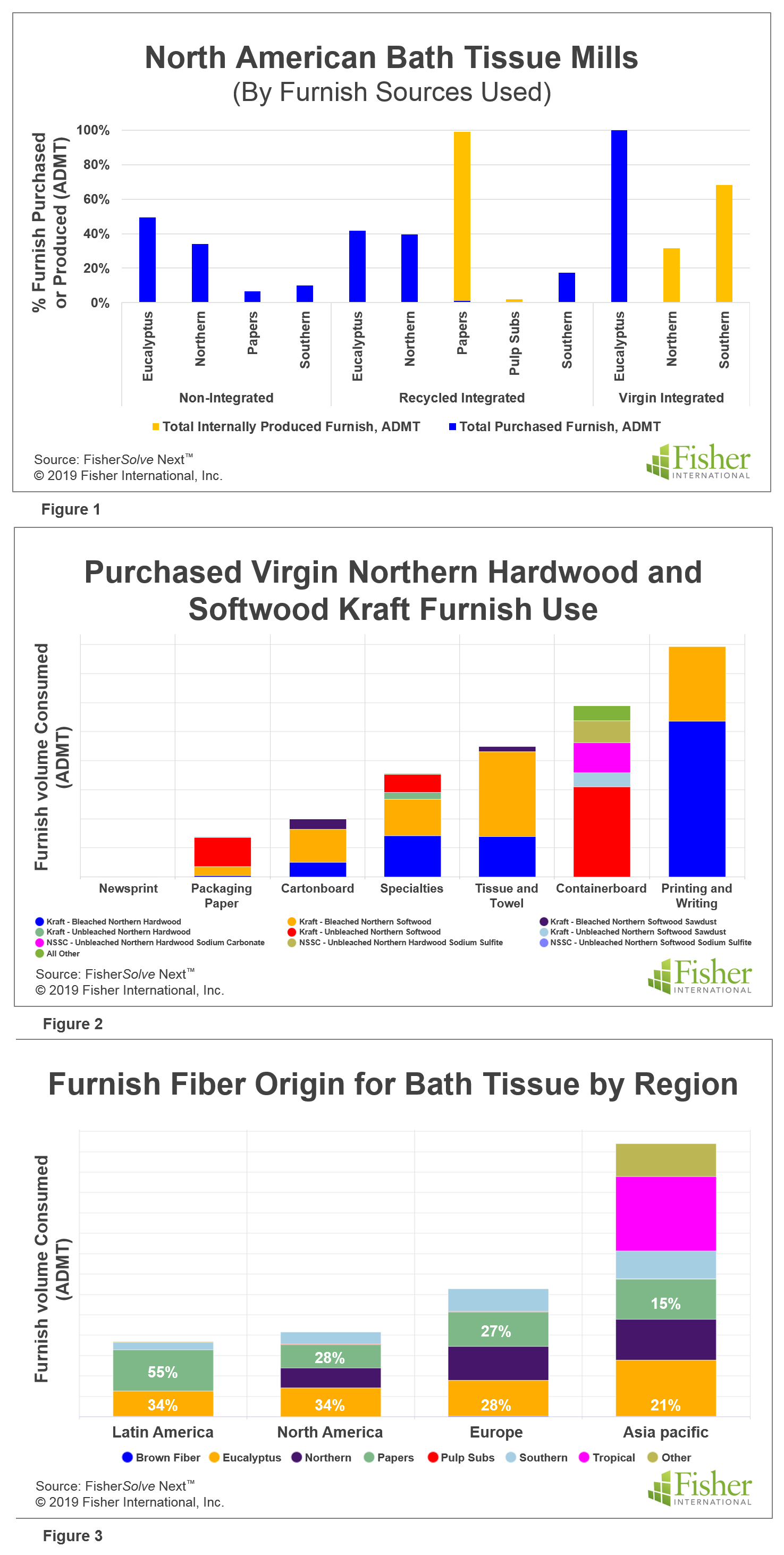

Map 2 shows the operating commercial and consumer bath tissue mills in the U.S. and Canada, where symbol size indicates volume of furnish consumed (ADMT).

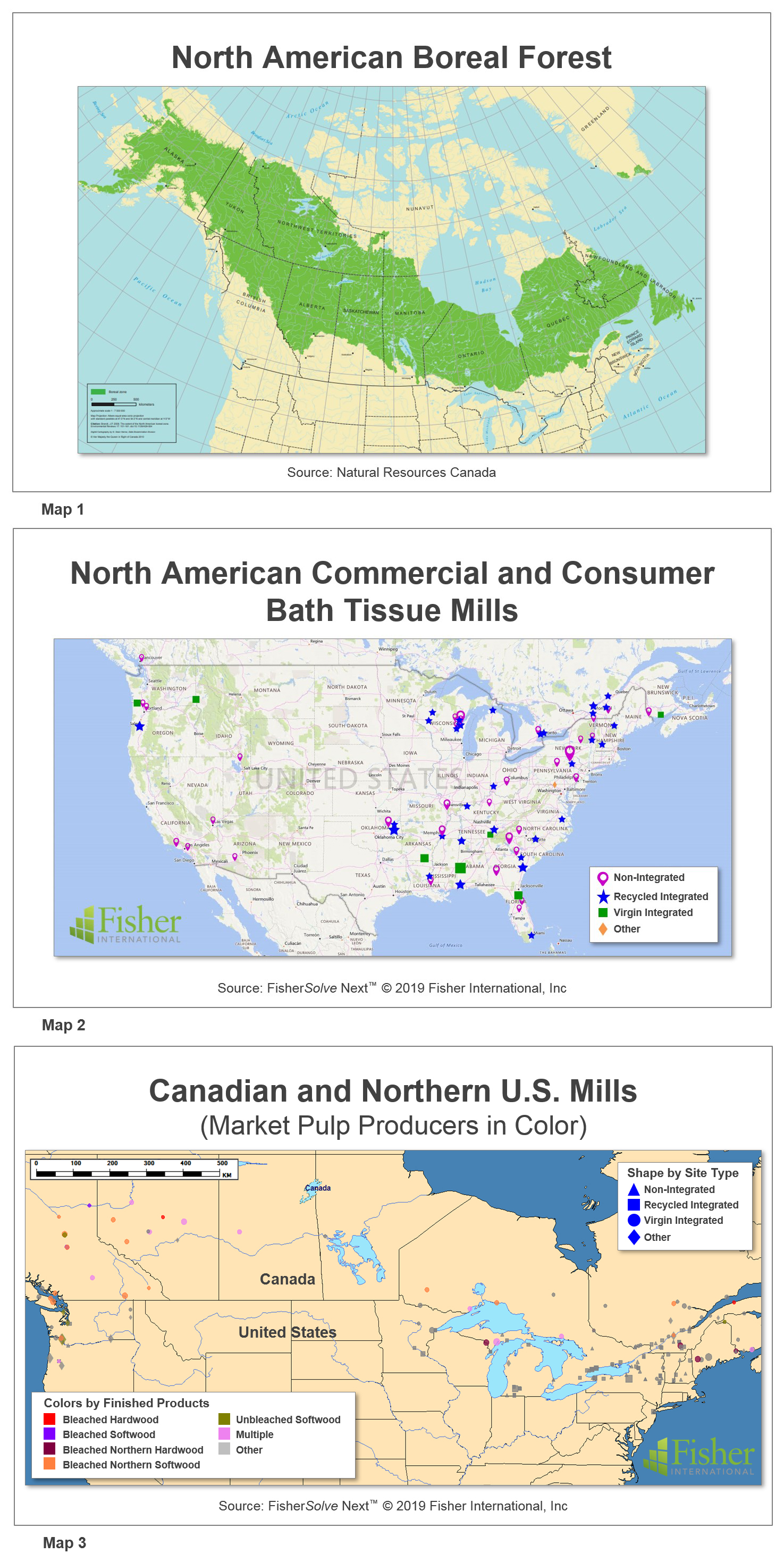

There are very few Canadian tissue mills compared to the number of tissue mills in the US, and without knowing exactly where the mills are sourcing their logs, chips, or purchased market pulp from, it is hard to know exactly what percentage of their virgin hardwood or softwood fiber is ultimately coming from what would be considered boreal forest versus timber plantations. However, it is safe to assume it to be a large percentage, as timber plantations in Canada and the northern US are rare compared to the southern US.

And so, it becomes a question of how much wood, chips, and/or market pulp are the US mills importing from Canada, versus buying from US market pulp producers, using boreal forest-sourced wood. In my experience, US mills don't often import logs or chips from Canada, unless there is some urgent need, so that use of boreal forest is likely low.

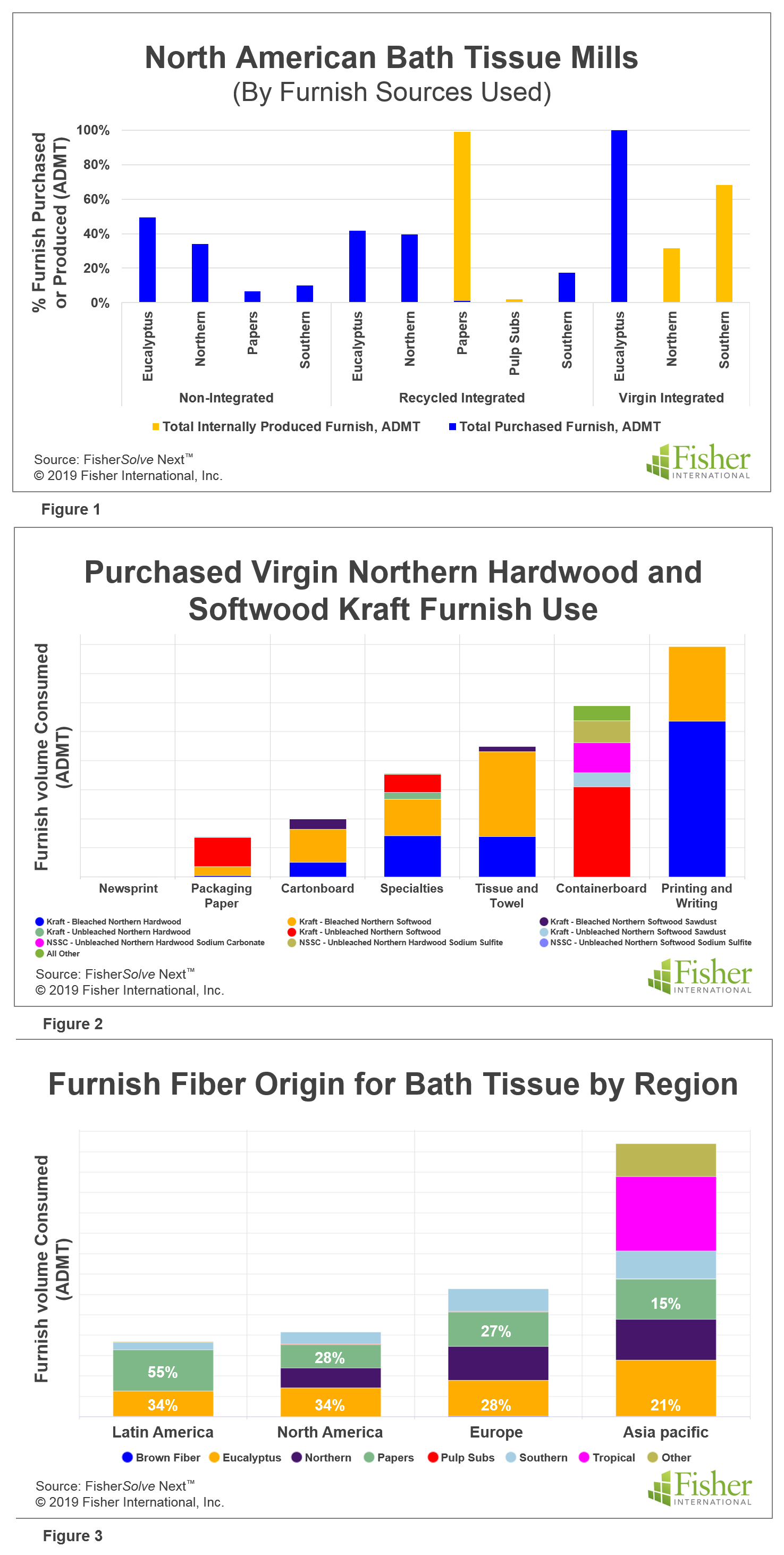

However, many of the bath tissue producing mills are non-integrated, and even the integrated mills will use purchased pulp in their furnish. This also means that 77 percent of the purchased furnish supplying North American bath tissue producers are other types of fiber, with 54 percent being bleached eucalyptus kraft (BEK). And although we see a low purchased deinked, bleached recycled fiber percentage, keep in mind that many of the bath tissue mills are recycled integrated mills, so they are processing recycled papers into recycled furnish on-site (Figure 1).

If the North American commercial and consumer bath tissue mills are purchasing so much eucalyptus fiber, then how much kraft furnish are they actually using in their sheets? And how much recycled? How does this compare with furnishes used in other paper grades?

In the case of kraft market pulp, northern bleached softwood kraft (NBSK) accounts for 23 percent of the purchased furnish used by North American commercial and retail bath tissue producing mills. Since there are few US NBSK producers (Map 3), the US tissue mills must import this from Canadian producers to a large extent, which in turn means the use of logs and chips from boreal forests is likely. Still, tissue and towel grades consume less purchased virgin northern softwood and hardwood than other grades produced (Figure 2).

Virgin Versus Recycled Fiber

Also, there are deforestation concerns in other parts of the world where tropical forests are being cut at concerning rates to supply industries, including paper, as well as to make room for agriculture, fiber plantations, and the like. As bath tissue use increases worldwide, how do the other regions stack up in their use of virgin versus recycled fiber in their tissue production compared to North America?

Of that commercial and consumer bath tissue production, recycled papers already account for over 25 percent of the furnish used in North America and Europe and about 55 percent in Latin America (Figure 3).

Eucalyptus fiber accounts for approximately 30 percent of the fiber used in those 3 regions as well, further closing the gap in virgin hardwood and softwood fiber from boreal or tropical forests. It is worth noting that eucalyptus falls into the hardwood bucket, and as a result, often gets overlooked as an alternative fiber source. Given that it is harvested on plantation farms and has a fast growth cycle, it is considered a respectable and more environmentally friendly option than traditional hardwood and softwood.

So, in total, North American bath tissue mills are already using at least 60 percent recycled and eucalyptus furnish for their production, as are European mills—which is more than perhaps one might have expected. Granted, commercial bath tissue uses more recycled fiber than consumer bath tissue, as consumer demands for strength, softness, and absorbency aren't quite as influential; but then this is where the eucalyptus comes into play for consumer bath tissue.

With increasing recycled papers supplies and falling prices, the potential to add more deinked, bleached fiber does exist. Wheat straw fiber also looks promising for replacing some of the virgin wood fiber in the sheet, without affecting fiber performance and the finished product quality. Bath tissue, since it doesn't end up back in the recycled papers stream, will be one of the best initial applications for wheat straw fiber, and it will be interesting to see how this develops.

Can North American and even European producers go even higher with their use of non-virgin and alternative fiber, including eucalyptus, as Latin American producers have? And while fiber sourcing is shifting to non-forested alternatives, what about the other environmental impacts? When the production of purchased fiber itself is included for the mills, and especially the non-integrated mills, to look at a full wood basket-to-consumer picture, what are the impacts of water use, energy use, and carbon footprint for bath tissue production?

This article originally appeared as a Fisher International "Insight" article. For more articles, or to sign up to receive Fisher Insights, go to www.fisheri.com.

About The Author:

Joanna Wilhelm is senior consultant, business intelligence, Fisher International. By virtue of its deep expertise in the pulp and paper industry, Fisher International provides insights, intelligence, benchmarking, and modeling across myriad scenarios. Visit www.fisheri.com.

For a modest investment of $174, receive more than US$ 1000 in benefits in return.

Visit www.tappi.org/join for more details. |

|